When gold hit a new all-time-high of $3,500 on Tuesday it put the spotlight on gold-backed tokens — a discrete class of cryptocurrencies that’s quickly capturing interest.

Last week the total market cap of gold-backed cryptocurrencies reached $2 billion, up from about $12.85 million in 2020. With Goldman Sachs predicting gold will hit $4,000 by the middle of next year, should investors make gold-backed tokens a staple in crypto portfolios?

The potential benefits are persuasive but limited utility in decentralized finance (DeFi) is a serious drawback. That could be about to change.

What are gold-backed cryptocurrencies?

Gold-backed cryptocurrencies are blockchain-based tokens redeemable for a specific measure of gold, typically 1 token for 1 troy ounce (31.3g) of gold.

They differ from mainstream assets like Bitcoin in that they are less subject to volatility, while their divisibility, transportability, and interoperability give them advantages over paper and physical gold.

Gold-backed cryptocurrencies offer a unique blend of stability and innovation by bridging the gap between gold — the original safe haven –and the dynamic world of crypto and blockchain. They offer investors an alternative inflation hedge and a shield from market volatility.

However, their integration into the broader crypto ecosystem remains a work in progress, with three core challenges yet to be overcome: regulatory uncertainties, liquidity constraints, and limited DeFi use cases.

Where tradition and innovation intersect

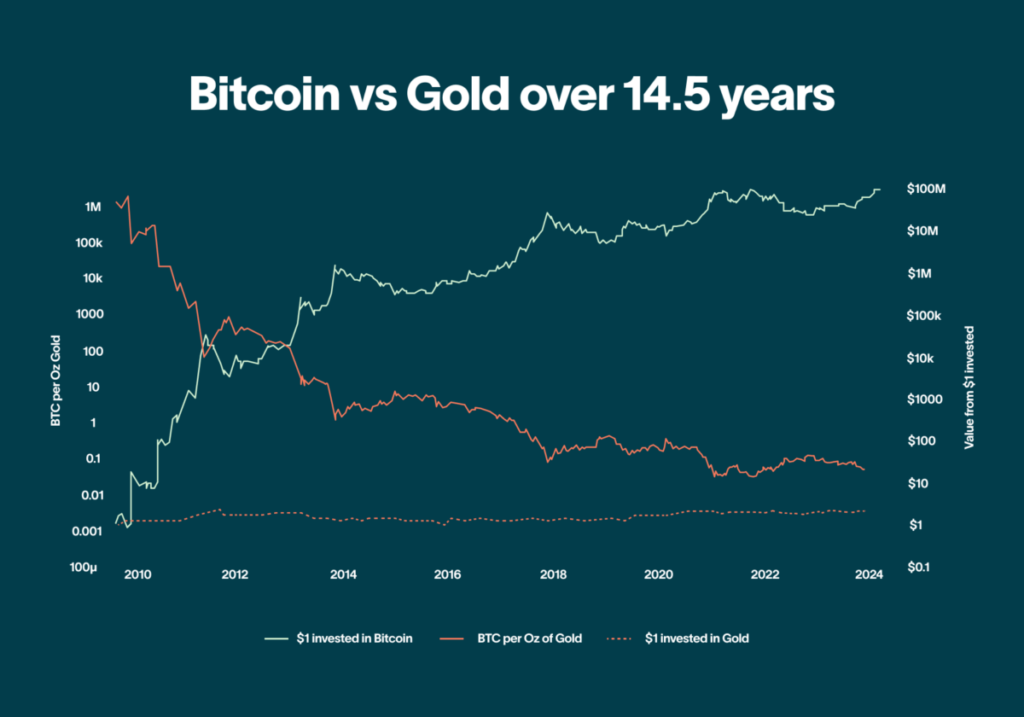

Crypto purists often say Bitcoin makes gold redundant since BTC shares similarities with the precious metal like capped supply and decentralized control. In unsettled times, however, gold’s ancient trading history and global acceptability have only strengthened its reputation as the world’s go-to safe haven.

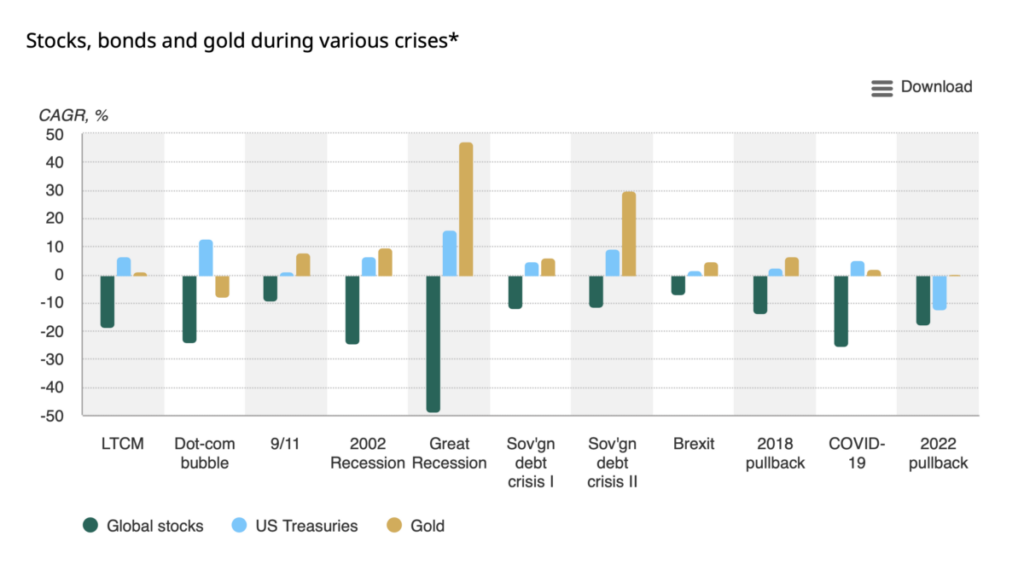

Bitcoin’s reliability as an inflation hedge is still up for debate while gold’s safe-haven status has been tested again and again. Through times of systemic risk – war, recession, high inflation, and other economic upheavals – its helped investors mitigate losses.

Since Donald Trump assumed office in January 2025, the market trajectories of gold and Bitcoin have diverged. Between January 20 and February 7, 2025, risk assets saw a sharp correction as the risk of a global tariff war stoked investor fear about rising inflation and slowing economic growth.

Bitcoin prices have fallen from their all-time high of $109,356 on January 20, 2025, to around $85,894 on March 20. During this period, the broader cryptocurrency market lost roughly $500 billion in market capitalization.

In contrast, demand for safe-haven assets has driven gold prices to multiple record highs since President Trump took office. The precious metal has surged as much as 6.6%, rising from $2,700 per ounce to a recent peak of $3,030 per ounce.

A recent report from rwa.xyz notes that gold and Bitcoin remain fundamentally different.

“Prevailing narratives that call Bitcoin “digital gold” overlook the unique qualities of each asset,” the firms’ analysts wrote. “Investing into gold is exposure to gold’s longstanding use case as a status symbol, inflation-hedge, and store of value. Investing into Bitcoin is exposure to a new technology, characterized by decentralized consensus, near-instant settlement, and arbitrary, programmable transactions.”

Gold as a tokenized asset

For crypto investors, gold-backed tokens can offer the best of both worlds, combining gold’s low-risk, safe-haven properties with blockchain advantages like global accessibility, instant settlement, low fees, and 24/7 trading.

Unsurprisingly, gold-collateralized tokens like Tether’s XAUT and Paxos’ PAXG have surged in popularity in 2025 as investors seek ways to protect their portfolios against global uncertainties.

In its report, rwa.xyz noted that investors are taking advantage of 24/7 crypto markets and tokenized products to gain instant exposure to gold during risk events, particularly on weekends (when traditional markets are closed).

However, trading data suggests that investors tend to return to traditional markets once they reopen. The firm cautions investors that the premium for XAUT and PAXG ‘almost always retreats once traditional markets reopen after the weekend’.

Analyzing the volume data for tokenized gold products across crypto exchanges, rwa.xyz says volumes tend to spike according to Saturday-Sunday market catalysts.

“This implies that traders are utilizing tokenized gold markets as a way to gain short-term gold exposure when traditional markets are closed. When traditional markets reopen, some traders return to traditional gold markets, the premium is arbitraged away, and volumes in tokenized gold markets tend to revert to normal.”

Limited DeFi appeal

This suggests that decentralized finance (DeFi) users may be reluctant to hold onto gold-backed tokens due to their limited on-chain use cases.

For instance, at the time of writing, neither Paxos’ PAXG nor Tether’s XAUT — the two largest tokenized gold products by market capitalization — can be used as loan collateral on Aave’s lending platform.

On decentralized exchanges (DEXs) like Uniswap, while PAXG and XAUT can be swapped for other tokens, users may be hesitant to trade them due to liquidity constraints and slippage concerns. For now, highly liquid and versatile U.S. dollar-pegged stablecoins — such as Tether’s USDTand Circle’s USDC — remain the preferred means for DeFi users to safeguard against market volatility.

That said, gold-pegged tokens still have a key advantage over fiat-backed stablecoins: gold’s historical negative correlation with the U.S. dollar and its limited exposure to monetary policy risks:

The takeaway

Spot gold is on the march, gaining 29% for the year to date while hitting 28 record highs in a row. Gold-backed cryptocurrencies offer a bridge between traditional precious metals markets and the on-chain world, but their integration into the crypto ecosystem is a work in progress. Key areas barriers include regulatory risk, transparency concerns, and limited DeFi use cases.

Whether gold-backed tokens become a staple of investors’ portfolios will ultimately depend on their ability to provide security and practical utility to both crypto enthusiasts and mainstream investors.