Here’s what we think is coming over the next week…

Did you see that coming? Because we didn’t… but we were ready for it.

What a wild week. After three months of noise, chop, and fakeouts, the market is now right back at new all-time highs. Did anyone truly see that coming? Probably not. But if you’ve been following this newsletter, you know we stayed generally bullish, even when sentiment was at its worst.

When everyone’s bearish, you stay bullish. That’s been the call. And it’s working.

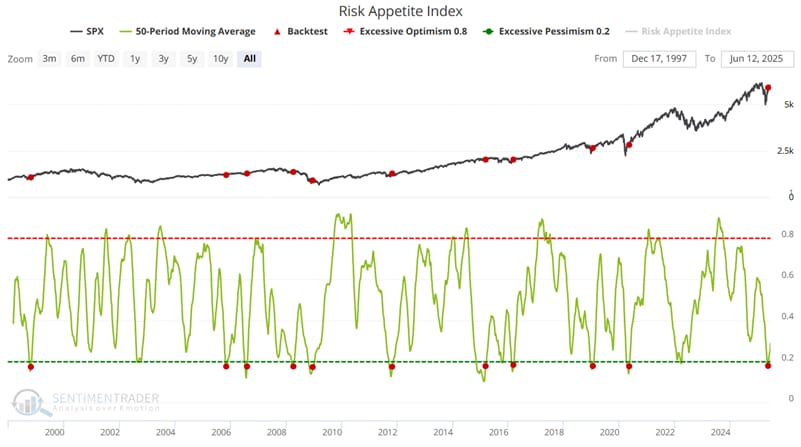

Risk Appetite Is Back

So just like when everyone’s bearish you stay bullish, we also need to be cognizant. The chart below shows risk appetite turning back on. Instead of retreating from risk, the market is leaning into it again. That could mean some surprisingly bright days ahead… yes, even now.

Not EVERYTHING is going to work anymore. We might very well be back to a stock picker’s market if you want alpha. But there is still a lot of juice left to squeeze on certain names.

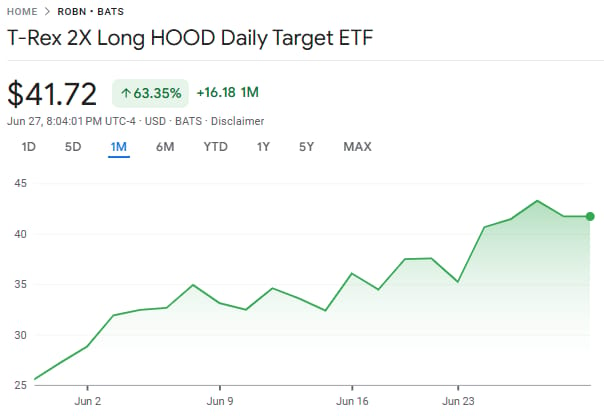

We’ve stayed long high-beta names, including our favorite sleeper-turned-star: HOOD. The new Wall Street darling. If you want to turn up the heat, Rex Shares launched a 2x Robinhood ETF, ROBN, and it’s been on fire… up 63% in just one month.

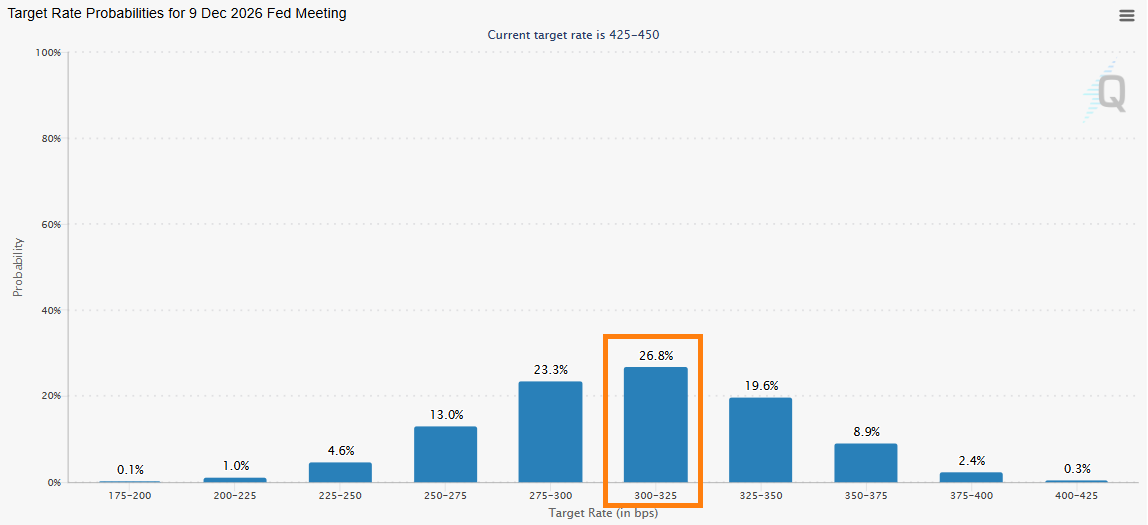

And here’s the kicker… the Fed is only expected to cut rates less than two times this year. Expectations are that low.

We flagged this back in our June issues: earnings yield and policy expectations were setting up for upside surprises in Q2.

Now look where we are… more bad expectations = more bullish setup.

If the Fed ends up cutting more than forecasted?

You better believe SPX could run to 7000. And Bitcoin? We’re thinking $150K is absolutely in play.

We are perfectly positioned into a new BTC all-time high.

**

check out our premium newsletter below to see why it’s worth subscribing.

So with that, let’s lock in the final details on our T-Rex 2X Long Bitcoin Daily Target ETF (BATS:BTCL) setup, courtesy of Rex Shares…

The BTCL trade is faring very well right now. We’ve already locked in a 6% gain at $54.00 by taking off 50% of the position. That means we’re now playing with house money, and we’ve moved our stop on the remaining half to breakeven at $51.00.

This week’s setup looks bullish, with a potential breakout from a textbook bull flag. We are also testing the upper band of a broader downtrend… but if we break out with volume, we could easily hit our next target at $57.13.

That’s where we plan to take off another 30% of the original position. The final 20% will remain as runners with stops trailing higher as momentum builds.

Looking ahead, we’re watching two names for our next swing candidates: BULL and IREN. We’re not chasing… we’re waiting for high-quality setups.

Stay safe!

We’ll update with more details if we get the setup. Stay sharp.

*

if you enjoyed the article so far (and we know you did), check out our premium newsletter to see why it’s worth subscribing.

Most Americans are stuck in debt while 60+ billionaires were made during COVID.

Why? Financial literacy.

Gav Blaxberg is a former Goldman Sachs analyst with 8,000+ hours teaching money strategy.

For $9/month, you’ll get weekly deep dives on stocks and actionable tips to grow your wealth.

Stop watching others get rich. Start learning how.

Join now and take control of your financial future.

**